RevOps for Heavy Equipment & Industrial Machinery

Win fleet-level CapEx decisions, enable dealer networks, and compress 12-24 month sales cycles with revenue operations purpose-built for heavy equipment manufacturers.

Why Heavy Equipment Revenue Teams Struggle

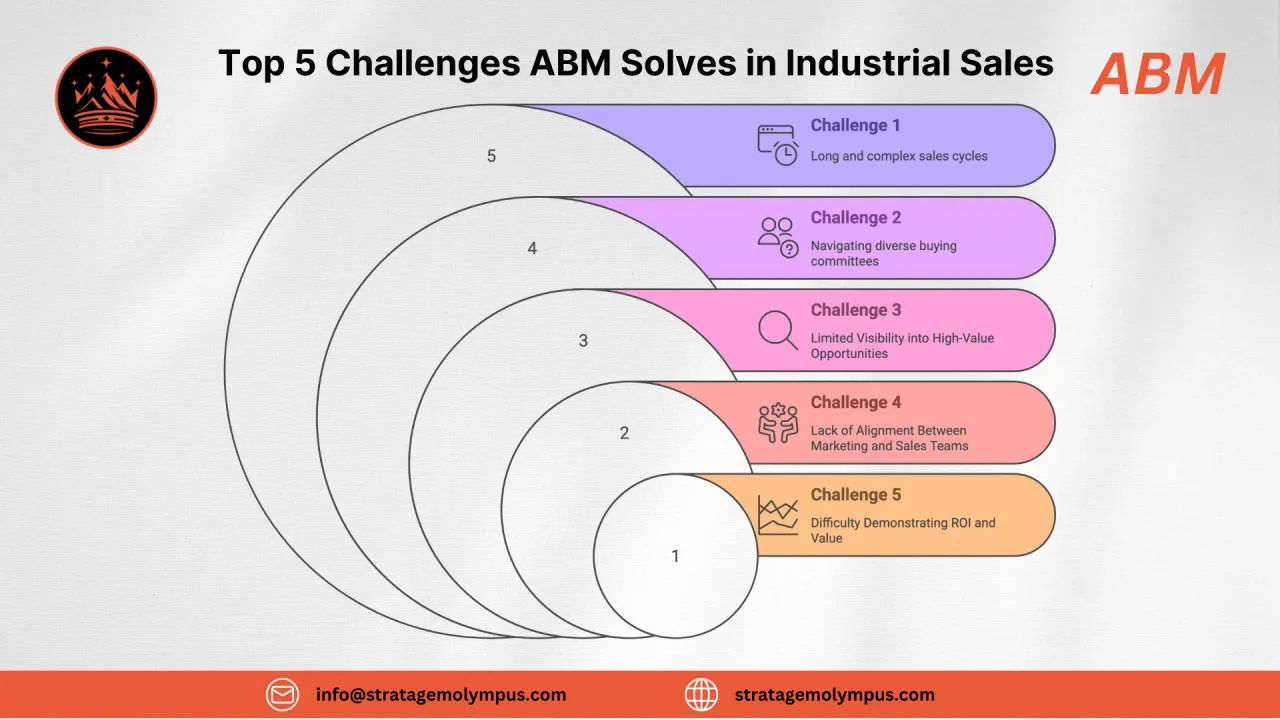

These are the operational bottlenecks we solve with structured RevOps for heavy equipment & industrial machinery businesses.

Fleet-Level Decision Complexity 01

Heavy equipment purchases are rarely one-unit decisions. Buyers evaluate fleet-wide standardization, total cost of ownership across dozens of units, and multi-year replacement cycles — requiring enterprise-grade account strategies.

Dealer Network Misalignment 02

Most heavy equipment OEMs sell through dealer networks with varying capabilities. Without co-marketing programs, shared pipeline visibility, and dealer enablement tools, channel performance is inconsistent.

CapEx Budget Cycles Override Intent 03

Even when a prospect is convinced, CapEx approval cycles tied to fiscal year budgets, board approvals, and financing structures can delay purchase decisions by quarters or years.

Aftermarket & Parts Revenue Disconnect 04

Parts, service, and rebuild revenue often exceeds initial equipment sales but lives in a separate silo. Marketing rarely nurtures installed base customers for upsell, cross-sell, or service contract renewals.

Field-to-CRM Data Gap 05

Sales reps and dealer contacts operate in the field, at job sites, and at industry events. Critical deal intelligence stays in email threads and notebooks instead of flowing into CRM for forecasting and automation.

Who's in the Heavy Equipment Buying Committee

Fleet / Operations Manager

Uptime, total cost of ownership, operator training, parts availability

TCO calculators, uptime case studies, operator training programs

VP Operations / COO

Fleet standardization, multi-site deployment, long-term capacity

Fleet planning tools, standardization ROI analysis, capacity roadmaps

Procurement / Sourcing Director

Volume pricing, financing options, vendor consolidation

Volume discount structures, lease vs. buy analysis, vendor scorecards

CFO / Finance Committee

CapEx vs OpEx, depreciation schedules, financing terms

Financial models, depreciation analysis, lease/finance comparisons

Safety & Compliance Manager

OSHA compliance, emissions standards, operator safety

Safety certifications, compliance documentation, training materials

The Heavy Equipment Sales Cycle

Heavy equipment sales involve extended evaluation periods, demo/trial phases, fleet-level ROI analysis, and CapEx approval processes that span fiscal year boundaries. Dealer involvement adds coordination complexity.

Need Identification & Outreach

Fleet replacement planning, new project requirements, dealer referrals

Demo & Field Trial

On-site demonstrations, operator evaluations, performance benchmarking

Fleet-Level ROI Analysis

TCO modeling, fleet standardization benefits, financing scenario planning

CapEx Approval Process

Board presentation support, budget alignment, financing structure finalization

Contract & Deployment

Volume agreements, delivery scheduling, operator training plans

SOHQ Services Mapped to Heavy Equipment

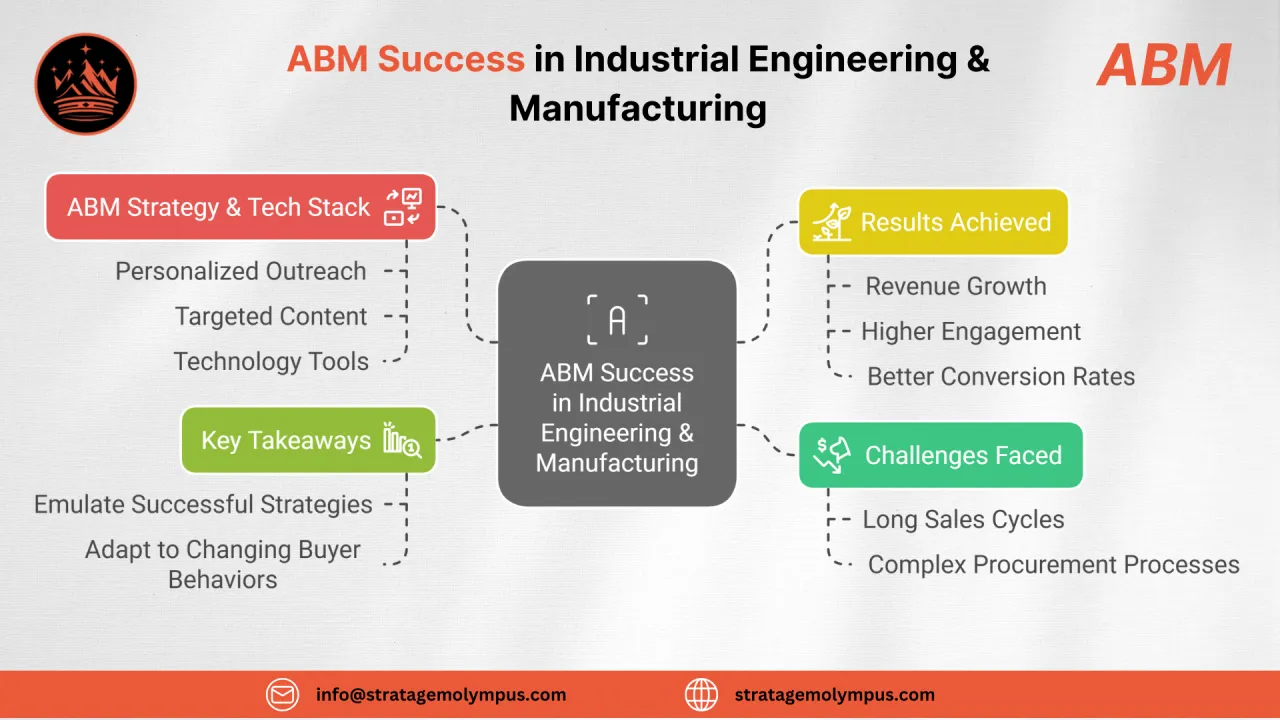

Account-Based Marketing

Engage fleet decision-makers and dealer networks with coordinated campaigns targeting specific accounts and their CapEx cycles

B2B Demand Generation

Publish TCO guides, fleet planning tools, and industry benchmarks that attract operations leaders researching equipment decisions

Sales & Buyer Enablement

Create dealer-ready sales kits, financial justification tools, and competitive positioning decks that work across the channel

Custom AI Agents + Workflows

Monitor fleet replacement signals, automate dealer co-marketing, and score accounts based on CapEx cycle timing and engagement

Unlock Efficiency, Drive Growth, Achieve Excellence Together

Are you ready to revolutionize your business operations and drive sustainable growth? Partner with us for innovative RevOps solutions tailored to your unique needs and goals.

Let's Work Together